kmi stock dividend yield

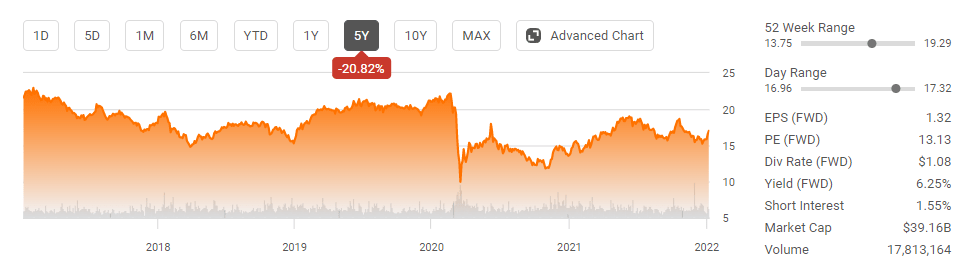

Offset inflation with passive income. 4 rows The current dividend yield for Kinder Morgan NYSEKMI is 582.

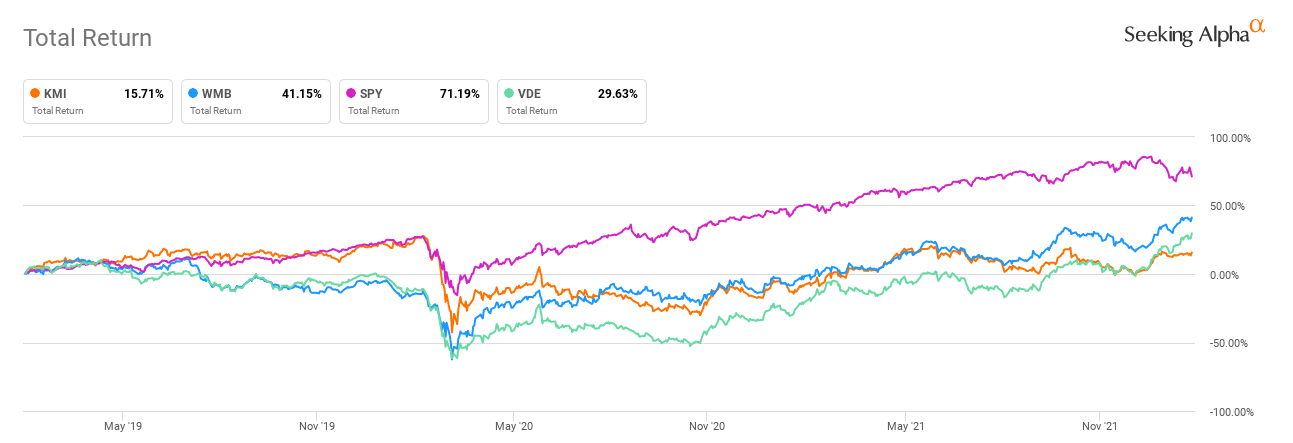

Kinder Morgan Should You Buy Kmi Stock For Its Natural Gas Exposure Dividend Yield Seeking Alpha

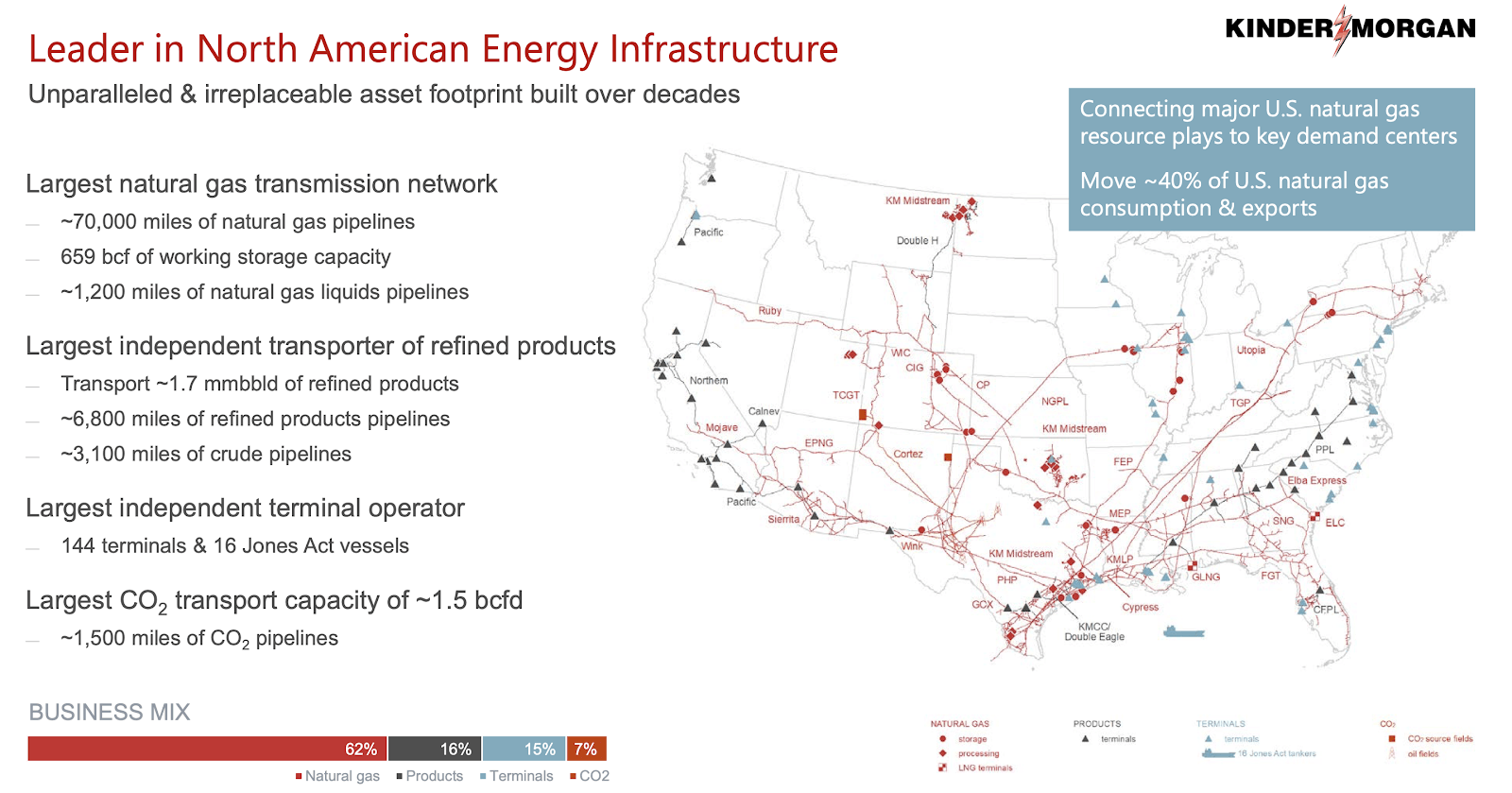

The dividend yield of 65 is lower than some peers but the high amount of retained cash flows gives KMI optionality to meaningfully repurchase shares.

. Kinder Morgans last quarterly dividend of 027 per share was on Jan 28 2022 ex-date. KMIs annual dividend yield is 648. Kinder Morgan dividend history payout ratio dates.

Kinetik pays an annual dividend of 600 per share and has a dividend yield of 94. Dividend 1 Yr Growth 107 104 100 3 Click the Edit pencil if you want to. Pays a dividend of 108 per share.

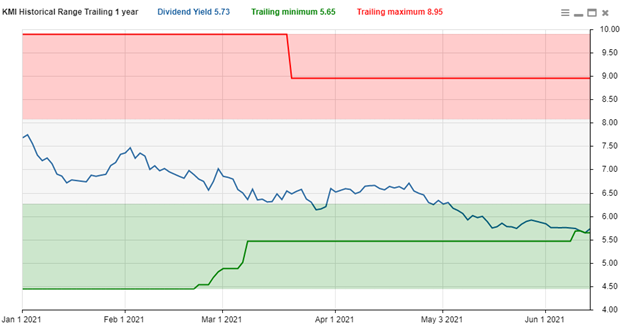

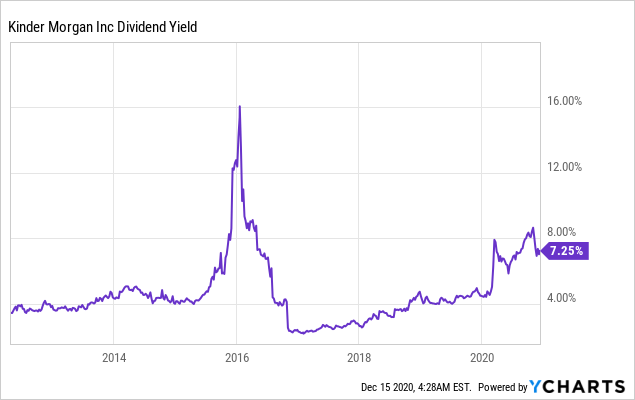

See why I believe that maintaining my buy rating is appropriate for KMI stock. Kinder Morgan KMI provided less dividend growth for 2022 than expected. 26 rows Dividend Yield Range Past 5 Years.

At the time of writing the stock offers a dividend yield of around 62. Using the current years Dividend Growth rate of 3 and projecting 3 forward the annual dividend income in 10yrs would be 000 with a yield on cost of 862. Kinder Morgans dividend is higher than the US Oil Gas Midstream industry average of 632 and it is higher than the US market average of 459.

18 hours agoAt the core of this investment thesis is stability. The dividend is paid every three months and the last ex-dividend date was Jan 28 2022. KMI Stock Quote and detailed dividend history including dividend dates yield company news and key financial metrics.

The annualized dividend payment of 108 per share represents a current dividend yield of 577. Learn more on KMIs. Dividend Yield History.

During the past 12 months Kinder Morgans average Dividends. As of today 2022-02-26 the Forward Dividend Yield of Kinder Morgan is 633. 12 rows Sector Median.

Dividend history for Kinder Morgan KMI-N yield ex-date and other distribution information to help income investors find and manage investments. Kinder Morgans 2022 guidance gives the stock a forward price to earnings ratio of 159 and a forward dividend yield of 63. Kinetik pays an annual dividend of 600 per share and has a dividend yield of 95.

KMI has a dividend yield of 597 and paid 108 per share in the past year. Compare KMI With Other Stocks. That looks incredibly attractive in the current interest rate environment.

The current TTM dividend payout for Kinder Morgan KMI as of March 14 2022 is 108. On top of this income there is also growth potential as the group expands its capital and infrastructure base over the next year. Rolling Last 4 qtrs dividends total 107 and Previous last 4 qtrs dividends total 104.

About Dividend Yield TTM For Kinder Morgan Inc the company has a dividend yield of 619 compared to the Oil and Gas - Production and Pipelines industrys yield of 551. Dividend Yield and Dividend History Highlights. Ad Search Ex-Dividend Dates Dividend Calendar All-Star Rankings More.

The 1 Source For Dividend Investing. Kinder Morgan pays an annual dividend of 108 per share and has a dividend yield of 58. Find the latest dividend history for Kinder Morgan Inc.

Historical dividend payout and yield for Kinder Morgan KMI since 2013. Kinder Morgans Dividends per Share for the three months ended in Dec. KMI has a compound annual growth rate of its cash flow of 05 higher than about 9258 stocks in our dividend set.

The current dividend yield for Kinder Morgan as of March 14 2022 is 597. KMI has issued more total dividends as measured in absolute US dollars over the past six years than 9433 of other US stocks currently paying dividends. 4 Year Average Dividend Yield.

Kinder Morgan pays. Four that stand out as great buys right now are EPR Properties EPR 084 Enbridge ENB 038 Medical Properties Trust MPW-121 and Kinder Morgan KMI-089. KMIs dividend yield history payout ratio proprietary DARS rating much more.

Kinder Morgan pays an annual dividend of 108 per share and has a dividend yield of 60.

Kinder Morgan Should You Buy Kmi Stock For Its Natural Gas Exposure Dividend Yield Seeking Alpha

Looking For High Yield Dividend Stocks These 3 Energy Stocks Are Good Buys Right Now

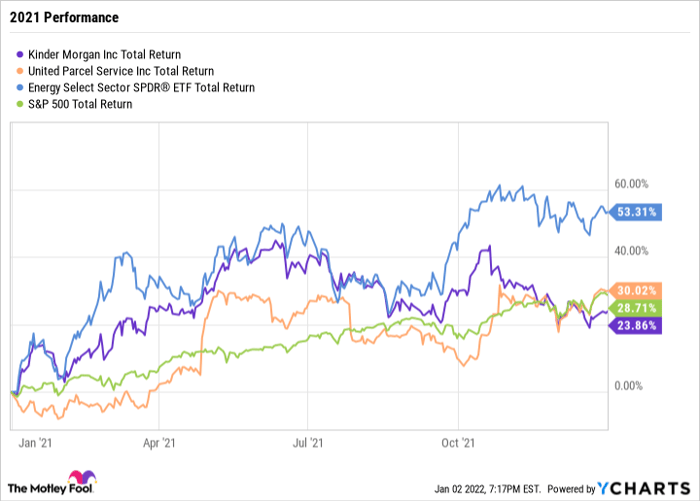

Double Your Money By 2033 On Dividends Alone From This Top Energy Stock The Motley Fool

My Top High Yield Dividend Stock To Buy Now The Motley Fool

5 Midstream Stocks Offering Dividend Yields Higher Than 6 The Motley Fool

Kinder Morgan Increase The 6 25 Dividend Yield With A Covered Call Strategy Kmi Seeking Alpha

Kinder Morgan I Am Buying This High Yield Pipeline And Midstream Co Nyse Kmi Seeking Alpha

Kmi Added As Top 10 Energy Dividend Stock With 6 11 Yield Nasdaq

Largest Oil And Gas Midstream Finance Investing Dividend Investing Money Management Advice

Kinder Morgan Should You Buy Kmi Stock For Its Natural Gas Exposure Dividend Yield Seeking Alpha

2 Wildly Undervalued Dividend Stocks To Buy In 2022 Nasdaq

5 Best Oil Stocks To Buy For Your Ira Inside Your Ira Oil Stock Finance Investing Investing

Lock In The 7 5 Dividend Yield Of Kinder Morgan Before It Falls Further Nyse Kmi Seeking Alpha

Adding Tapestry Forbes Dividend Investor November 15 Weekly Review Dividend Real Estate Investment Trust Forbes

What Is Dividend Yield Definition Formula Usefulness For Investors

Is Kinder Morgan Stock A Buy The Motley Fool

Dividend Yield High Dividend Yield Stocks Dividend Yield Ratio Dividend Yield Meaning